Tech Professionals

Divorce for IT Professionals and Developers is Complicated

Professionals in the Technology Industry – including computer programmers, software developers, and hardware/software engineers – face a specific set of issues during the divorce process. Some of these issues are obvious, and technology professionals and developers frequently ask a number of common questions at their initial consultation with a family law attorney. For example:

- How do you divide Restricted Stock Units or Stock Options that haven’t vested yet?

- Does the non-employee spouse have a right to unvested options or units? If so, how many?

Other questions about divorce and family law, however, are not readily obvious to tech professionals and their spouses. Suppose the court awards a non-employee spouse an interest in unvested Restricted Stock Options. Now suppose the software developer/engineer quits their job to take a new job at another software company. When a developer leaves their existing employer, they typically forfeit any unvested RSUs. So what happens to the non-employee spouse’s court-ordered interest in those unvested RSUs? Is it simply lost?

Or suppose the software developer is likely to be offered a better position in another state in the near future; if you’re still married, should you file for divorce now or wait until after the relocation? How will another state’s laws impact the division of property? And how will the timing of the divorce affect how new signing bonuses are allocated between the parties?

While perhaps not obvious to the parties themselves, these potential issues can have an enormous impact on the outcome in a tech divorce – which is why it is critical for IT and other technology professionals and their spouses to consult with and retain a knowledgeable family lawyer with plenty of experience in tech-sector divorce.

In Divorce for IT Professionals and Developers, Bonuses May or May Not be Community Property

Suppose the parties separate in August and the husband receives his Microsoft bonus package in September. Because the bonus occurred after the parties separated, you might be inclined to think it’s his separate property – but it might actually be community property. The answer turns on what the bonus is for.

If the bonus is awarded because of the husband’s stellar performance over the last year – a period prior to separation and during which his efforts belong to the marital community – then the bonus will be deemed community property. Think of this bonus as a delayed compensation that was being earned while the parties were still married.

However, if Microsoft characterizes the bonus as an incentive for the husband to work in the future, then the bonus will be his separate property. Think of this bonus as compensating the husband for work anticipated in the future – a period after separation and during which his efforts no longer belong to the marital community.

The same is true for signing bonuses. Suppose a software developer is given a restricted stock award at Amazon that fully vests in four years. After the four years are up, let’s suppose the worker lands a new job at Google and is rewarded with a generous signing bonus. If the developer filed for divorce prior to taking the new job at Google, then that signing bonus would probably be separate property.

However, if Google recruited the software engineer prior to the vest at Amazon, and Google offered an even bigger signing bonus in recognition of the abandoned unvested Amazon RSUs, a substantial portion of the Google signing bonus would, in effect, be a buy out of the abandoned Amazon RSUs. That fact would allow the non-developer spouse to argue that a good portion of the Google signing bonus – or at least that portion of it constituting the buy out of the community’s Amazon RSUs – belongs to the marital community.

Stock Options/RSUs Are Divided Based on A Time-Weighted Formula in Divorce for Technology Professionals

Restricted Stock Units and Stock Options are invariably awarded to technology professionals on a graded vesting schedule, usually between two to five years. That means that a RSU awarded today to a computer programmer might not vest until five years from now. Now, let’s suppose our hypothetical computer programmer separates from her husband in three and a half years. This presents two issues: first, determining how many of the RSUs, if any, get awarded to her husband; and second, figuring out how to actually transfer ownership of an unvested RSU.

Courts start with the premise that labor done – and wages earned – by either spouse during the marriage and prior to separation is community property. Labor done and wages earned after separation are the separate property of the laboring party. With that in mind, Washington courts view each vest in the schedule as delayed compensation for the prior year of work. So the vest at the start of year two is compensation for work done in year one; the vest at the start of year three compensates for work in year two; and so on. The character (whether community or separate) of the vested RSU is determined by the character of the labor that earns it. Returning to our hypothetical computer programmer, we start by constructing a timeline of the vesting schedule to which a court would then apply the above principles. For simplicity, let’s assume the programmer is awarded 100 RSUs on a straight, five-year vesting schedule (“Table 1”).

The 60 RSUs vesting one, two, and three years from now were all earned prior to the parties’ separation in 3 ½ years, so these are community property. The 20 RSUs granted five years from now were earned between year four and five – after separation. Accordingly, the last vest of 20 RSUs is separate property. The vest at year 4 was earned by the labor performed over the previous year, but the parties separated at the 3 ½ year mark, so some of the labor is community and some of it is separate.

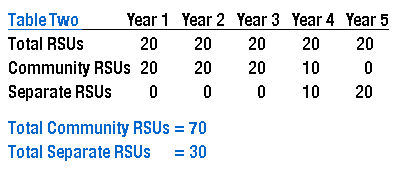

A Washington court will apply a time-weighted formula to determine the community and separate portions of this labor. To do that, we simply divide the number of days prior to separation in year 4 by 365 and multiply that ratio by the number of RSUs vesting in year 4. In other words, because she spent half the year earning those 20 RSUs as a married person, half of those RSUs are community property; the remainder are her separate property. This analysis produces the following tally (“Table 2”):

This is often referred to as a Short analysis, named after a somewhat famous case involving a Microsoft employee that was decided by the Washington Supreme Court in 1995, In Re Marriage of Short, 125 Wn.2d 865 (1995).

While a Washington court is free to divide separate and community property however it wants, a good starting point would be to assume that community property is split 50/50 and each party is awarded all of their separate property. In the above example, the programmer would receive half of the 70 community RSUs and all of her 30 separate RSUs for a total of 65 RSUs. Her spouse would receive only half of the 70 community shares for a total of 35 RSUs.

As to how these 35 RSUs (all of which would be unvested at separation) would be transferred to the spouse, the court would order the computer programmer to hold the 35 unvested RSUs in trust for her ex-spouse. Once the 35 RSUs vest, the programmer would then be required to transfer them to an account designated by her ex-spouse.

Employees Often Face Jurisdictional Questions in Divorce for IT Professionals and Software Engineers

It is not uncommon for IT professionals and software engineers to change jobs several times over the course of their career. Sometimes the move is an internal transfer; other times they move to another FANG (Facebook, Amazon, Netflix, Google) company, or perhaps join a start-up. In either event, the move often comes with a geographical relocation as well. Because the high-tech industry is dominated by a handful of monopolies, these relocations are highly concentrated.

Of the ten largest U.S. Tech companies (measured by revenue), all but one is headquartered in either California or Washington. Of the approximately $1.9 trillion in combined 2023 annual revenue of these ten companies, roughly $750 billion is generated by Washington-based tech companies and $1.1 trillion is generated by California-based tech companies. Accordingly, it is no surprise that one of the most common interstate relocations for tech workers is between Washington and California. As a result, if the divorce and the relocation coincide, tech professionals are often confronted with the choice of whether to get divorced in either Washington or California.

Divorce for Technology Professionals: the Difference between Washington and California Family Laws

While both Washington and California are community property states, their laws differ in some important ways. To begin with, the Short Analysis described above is not used in California. Instead, California uses a slightly different analysis that can substantially favor the non-tech worker spouse. In California, the court is required to divide community property 50/50 and is prohibited from awarding one spouse’s separate property to the other spouse. Washington courts, by contrast, are free to award lopsided divisions of the community – and they have the authority to “invade” one party’s separate property and award it to the other spouse.

Finally, in California, courts routinely award “lifetime” spousal support for marriages of only ten years. In Washington, courts generally would award “lifetime” maintenance only after 25 years of marriage. As you can imagine, there are several other important differences between California and Washington law. And the fact that many tech workers have to navigate these jurisdictional issues only adds to the complexity of their divorce.

S.L. Pitts has Experience in and Expertise with Divorce for Technology Professionals

Our family law attorneys have years of experience representing either IT professionals and developers or their spouses in a divorce. We understand and are able to both educate and advise clients on the key issues impacting their divorce. If you or your spouse are in the tech industry and you think you may be getting a divorce, it’s critical to meet with an experienced attorney early to ensure that you understand your legal rights and obligations. Choices made early in the process often cast a long and irreversible shadow, particularly when it comes to jurisdictional questions. Contact us to schedule an appointment with one of our knowledgeable family lawyers today.